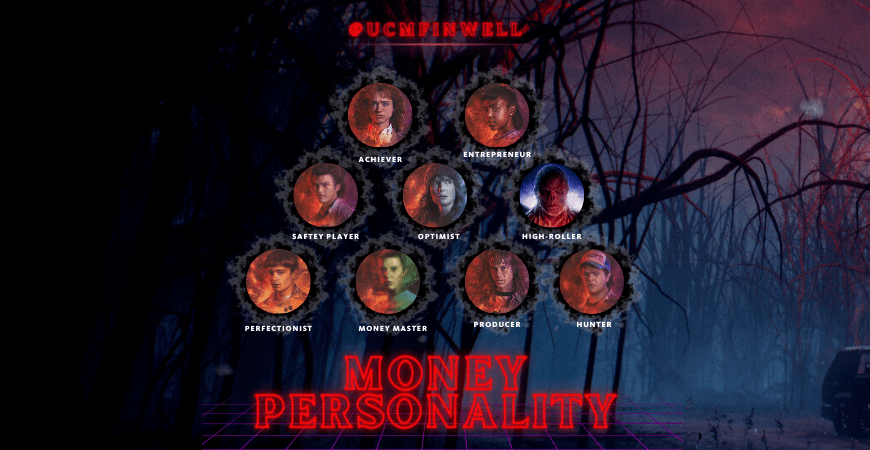

In honor of the Stranger Things theme for this year’s Financial Wellness Month, I thought it would be fun to take the 9 money personalities Dr. Kathleen Gurney identified after over 30 years of research and examine what characters from the show relate to them.

The real question is- which one are you?

(Warning: I tried to minimize spoilers, but be warned! There are some in here)

**Image Credits: Netflix

Erica Sinclair (The Entrepreneur)

Usually rank as the higher income earners, they tend to be workaholics who are not motivated by money alone. They use it as a scorecard to measure their success. They reward themselves with the best cars, homes, wines, and investing in the stock market is their favored strategy.

Dustin Henderson (The Hunter)

Usually highly educated, average to above-average income earners who make purchase decisions with their hearts rather than their heads. They have a strong work ethic, but attribute their success to “luck” versus ability and judgment. They lack confidence when it comes to making good decisions about money.

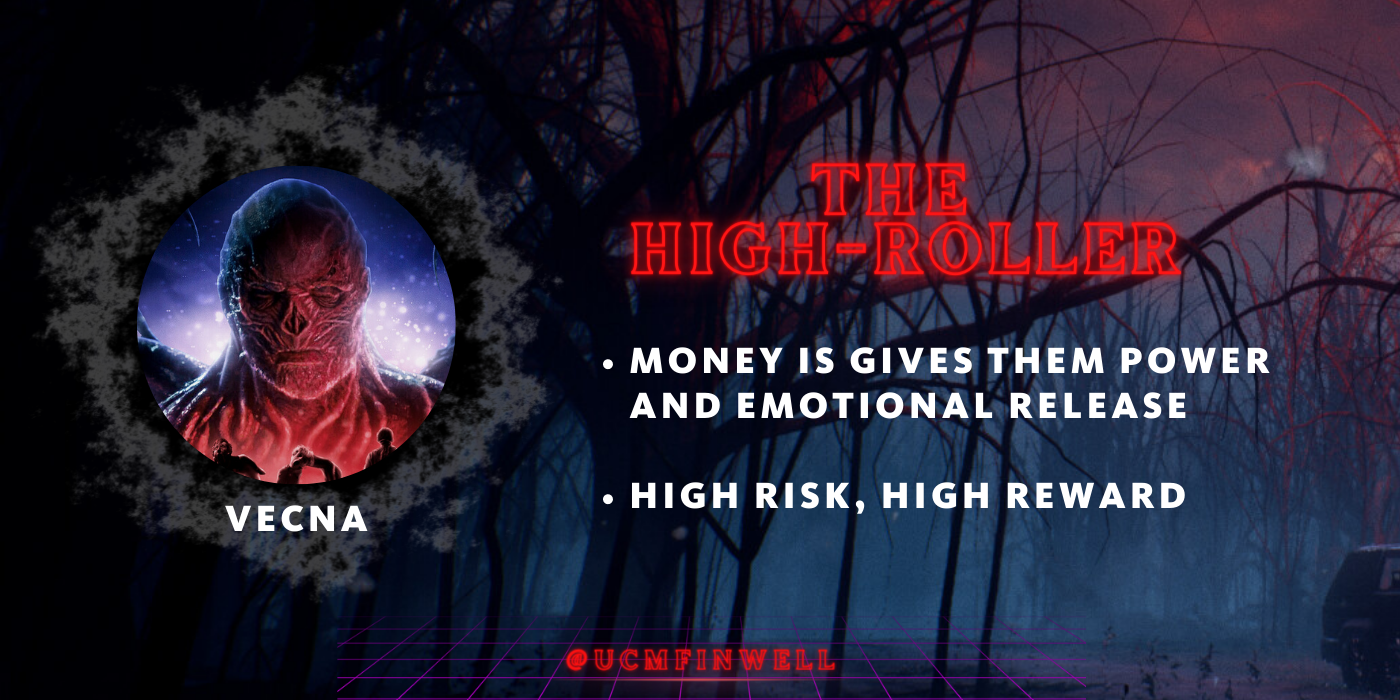

Vecna (The High-Roller)

Money brings them instant power and recognition. They are creative, competitive, and extroverted—they work hard and play harder and money for them is an emotional release. They prefer to risk their assets rather than sit back and be bored by financial security.

Steve Harrington (The Safety Player)

They are average earners and most of their money goes into safe and secure investments. They miss opportunities for more financial growth by not taking calculated risks. They feel they are doing just fine—and are resistant to making any changes to their investment strategies.

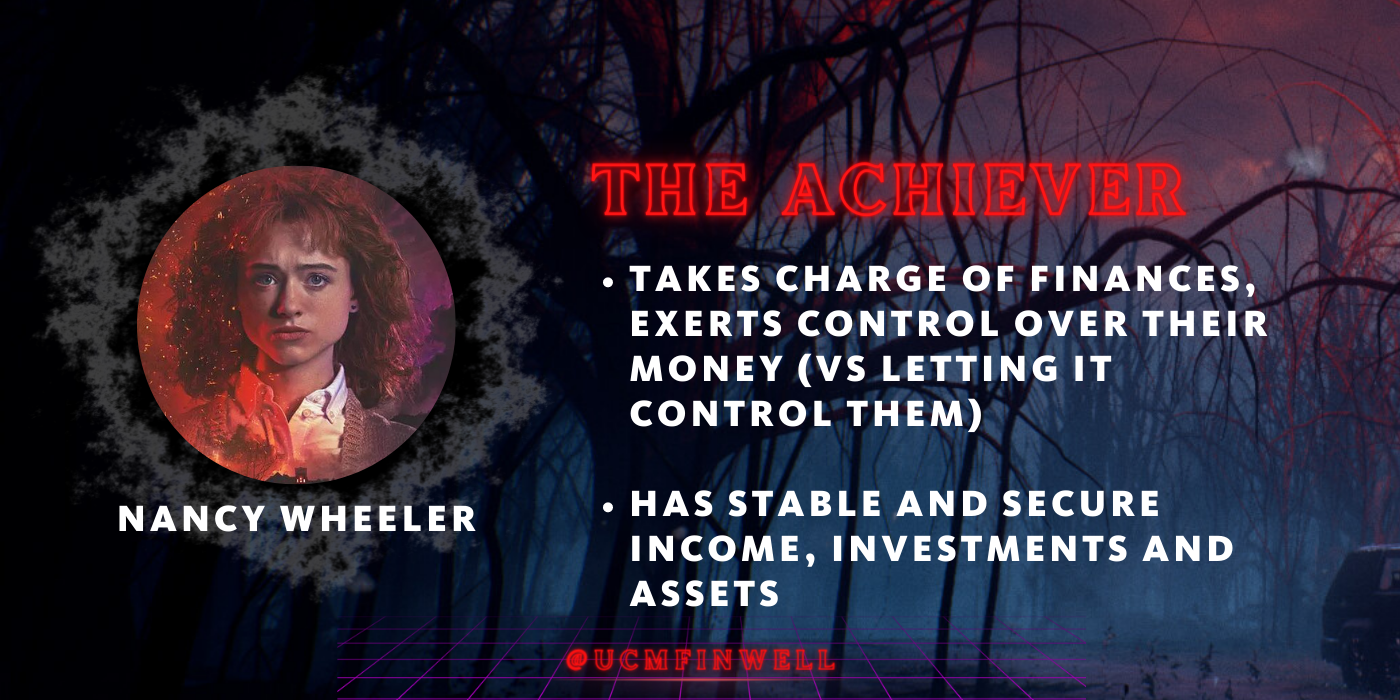

Nancy Wheeler (The Achiever)

Usually a college graduate—mostly married! They feel work and effort will pay off in the long run. They tend to distrust others’ honesty when it comes to money. Being the “take-charge” type, they have a strong need to control their money.

Will Byers (The Perfectionist)

If anyone’s been more paralyzed by fear in the show it’s been Will- sometimes literally. Money Perfectionists are afraid of making mistakes—so they also avoid making financial decisions altogether. Money perfectionists are known to consider every angle and find fault with almost all investment decisions, which ends up meaning they often don’t make a move at all unless someone else makes that decision for them. They do TRY to save, but often lack self-esteem when it comes to investing.

Eleven (The Money Master)

Money Masters accumulate the most wealth out of all of the money personalities- even though they don’t earn the most money. They trust the recommendations of others, succeed in their new reality, evolve, and are constantly open to learning new (money) skills. They make sound investments in the resources available to them and are highly adaptable.

Eddie Munson (The Producer)

Eddie usually looks at things at face value before he’s convinced otherwise. He runs right into situations before carefully taking a moment to thing about what he’s getting himself into. Producers are hard workers (Eddie had to be to learn how to shred those sweet Master of Puppets riffs). They desire more money, however, they often have difficulty in “getting ahead”. They don’t understand how the money systems work and lack the confidence to make financial decisions—because they don’t take the time to understand what they’re getting involved in.

Joyce Byers (The Optimist)

Joyce plays the long game in the show- and takes small, calculated risks to slowly obtain her goals. Optimists are often closer to retirement age—and they find security in the money that they have carefully saved. Their financial instincts may be impulsive, but do not naturally involve high risk. They are not heavily concerned with investments or taxes—which could cause stress later on.

Charah Coleman, MBA

Charah Coleman, MBA

Founding Financial Wellness Coordinator

Charah Coleman is the founding coordinator of UC Merced’s Financial Wellness Center. She is an award-winning behavioral finance expert and certified Educator of Applied Compassion. Read more about her here!